DID YOU KNOW? An Insured Wedding May Lead to Happily Ever After

.jpg)

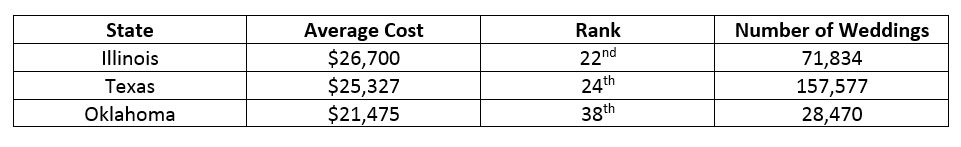

Engaged? According to the wedding industry research company The Wedding Report, Inc., the average cost of a wedding ranges from a low of $15,518 in Mississippi to a high of $39,078 in Hawaii. The average cost for our home states of Illinois, Texas, and Oklahoma were in the middle of the pack (2017 data):

With this much money, time and planning dedicated to a single day, wedding insurance should be considered to make sure the Big Day is remembered for all the right reasons.

Your homeowner’s and personal umbrella policies will provide some coverage for liability and theft of gifts, but it may be more prudent to transfer the risk to a separate policy, especially if your venue is requiring an insurance certificate.

For a little over $500, a wedding insurance policy can provide up to $25,000 of coverage for cancellation or postponement of the ceremony and up to $1,000,000 of liability coverage, including liquor liability. The policy includes the ceremony, reception, rehearsal and rehearsal dinner and offers separate limits of coverage for the following:

· Defective, lost, or damaged professional photographs and video

· Last-minute additional and unforeseen expenses

· Damage to wedding gifts

· Lost or damaged wedding attire for the bridal party

· Lost deposits if a vendor goes out of business or fails to show up for your wedding

Other special events, such as a Bar/Bat Mitzvah, Quinceanera, or Anniversary can also be insured on a similar policy.

Have questions about event insurance? David Miller has answers. Miller, who writes the monthly, DID YOU KNOW? blog is The Plexus Groupe’s Vice President, Client Executive for Private Client Solutions. Miller can be reached by calling 846-307-6141.